The U.S. Securities and Exchange Commission (SEC) continues its aggressive push to regulate the burgeoning crypto industry, with its latest target being OpenSea, the popular NFT marketplace. Devin Finzer, CEO of OpenSea, expressed shock after receiving a Wells notice from the SEC—a formal warning that the agency intends to pursue legal action against the company for the alleged sale of unregistered securities. This notice has set off a significant debate about whether NFTs should be classified and regulated in the same manner as traditional securities.

Finzer’s response to the SEC’s notice was both swift and firm. In a post on social media platform X, he argued that NFTs, which include digital art, collectibles, video game items, and event tickets, should not be subject to the same regulations as financial instruments like collateralized debt obligations. He emphasized that NFTs are “fundamentally creative goods,” and regulating them as securities would not only misinterpret existing laws but also harm artists, collectors, and the broader NFT market.

The SEC’s investigation into NFTs is not entirely new. The agency has been scrutinizing the crypto industry for years, and in 2022, it expanded its focus to include NFTs, reportedly issuing subpoenas to determine whether these digital assets could be classified as securities. High-profile cases, such as the investigation into Yuga Labs—the company behind the Bored Ape Yacht Club—illustrate the SEC’s growing interest in this area. More recently, the SEC charged companies like Impact Theory, LLC, and Stoner Cats with selling NFTs that it deemed to be unregistered securities, leading to settlements.

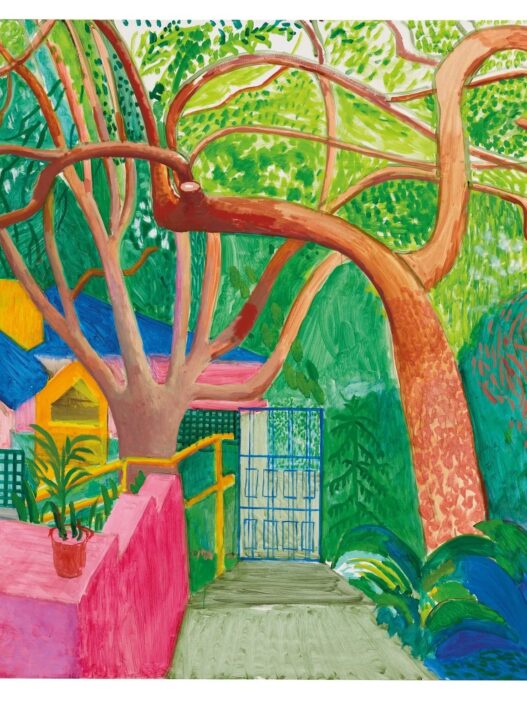

In a detailed statement on OpenSea’s website, Finzer further elaborated on the potential consequences of the SEC’s actions, warning that classifying NFTs as securities could stifle innovation, jeopardize artists’ livelihoods, and disempower collectors and gamers. He argued that the SEC’s approach could set a dangerous precedent for the art world, drawing parallels to a 1976 decision in which the SEC ruled that art galleries did not need to register artworks as securities, even though art can be purchased for aesthetic value, investment potential, or tax reasons.

The ongoing legal battle has also seen support from other figures in the crypto industry. Stuart Alderoty, chief legal officer for Ripple, highlighted the SEC’s inconsistent stance by sharing a 1976 document that permitted art galleries to sell lithographs without registering them as securities. This historical precedent is now being used to challenge the SEC’s current actions against NFTs.

Adding to the legal pushback, two artists, Jonathan Mann and Brian L. Frye, have filed a lawsuit against the SEC, questioning its authority to regulate NFTs. Their lawsuit seeks a declaratory judgment and raises critical questions about the implications of the SEC’s actions for the art world. Should artists be required to disclose risks and comply with federal securities laws merely to sell their art? Or should they be free to create and sell without fear of regulatory overreach?

In a show of solidarity with the broader NFT community, Finzer announced that OpenSea would allocate $5 million to cover legal fees for any NFT creators who also receive Wells notices from the SEC. “Every creator, big or small, should be able to innovate without fear,” Finzer stated, underscoring the stakes of this ongoing battle between the crypto industry and regulators.