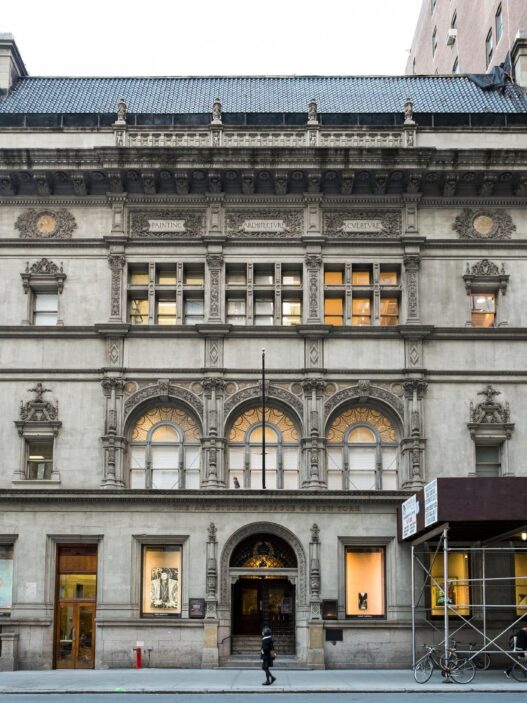

Abu Dhabi’s sovereign wealth fund, ADQ, has reached an agreement with Patrick Drahi, the French-Israeli telecom magnate and current owner of Sotheby’s, to acquire a minority stake in the renowned auction house. The transaction, valued at $1 billion, is expected to be finalized by the end of 2024.

The deal involves ADQ purchasing newly issued shares of Sotheby’s, aimed at reducing the auction house’s leverage and bolstering its plans for growth and innovation. Despite the new investment, Drahi will retain his position as the majority shareholder, further contributing capital to the company as part of the agreement. The majority of the $1 billion investment will be provided by ADQ, as confirmed by a Sotheby’s spokesperson, though details regarding the auction house’s total valuation were not disclosed.

Industry experts are not surprised by this development, as speculation about Drahi seeking a private sale or public offering of Sotheby’s shares has been ongoing since 2021. In 2022, reports suggested that the Qatar Investment Authority, another Gulf sovereign wealth fund, was among the potential investors interested in acquiring a minority stake in the company.

The backdrop to this deal includes the financial pressures faced by Drahi’s business empire, particularly Altice, the multinational telecom company he founded. Altice is reportedly managing a substantial $60 billion debt, accumulated through extensive borrowing during an era of low interest rates.

In a statement, Sotheby’s CEO, Charles Stewart, expressed enthusiasm about the new partnership: “We are delighted to welcome ADQ as a shareholder to Sotheby’s. We embrace their long-term vision of our business, and this investment is a testament to what we have achieved so far as well as our significant potential for future growth. The additional capital and investment expertise will enable us to accelerate our strategic initiatives, expand our commitment to excellence in the art and luxury markets, and continue to innovate to better serve our clients around the world.”